A Nation investigation

illustrates the moral hazards surrounding the Gates Foundation’s $50 billion

charitable enterprise.

MARCH

17, 2020

Bill Gates speaks at the

2019 New York Times Dealbook. (Mike Cohen / Getty Images for The New

York Times)

Last fall, Netflix premiered a three-part documentary

that promises viewers a rare look at the inner life of one of history’s most

controversial businessmen. Over three hours, Inside Bill’s Brain shows

us a rare emotional side to Bill Gates as he processes the loss of his mother

and the death of his estranged best

friend and Microsoft cofounder, Paul Allen.

Mostly, though, the film

reinforces the image many of us already had of the ambitious technologist,

insatiable brainiac, and heroic philanthropist. Inside Bill’s Brain falls

into a common trap: attempting to understand the world’s second-richest human

by interviewing people in his sphere of financial influence.

In the first episode,

director Davis Guggenheim underlines Gates’s expansive intellect by

interviewing Bernie Noe, described as a friend of Gates.

“That’s a gift, to read 150

pages an hour,” says Noe. “I’m going to say it’s 90 percent retention. Kind of

extraordinary.”

Guggenheim doesn’t tell

audiences that Noe is the principal of Lakeside School, a private

institution to which the Bill & Melinda Gates Foundation has given $80

million. The filmmaker also doesn’t mention the extraordinary conflict of

interest this presents: The Gateses used their charitable foundation to enrich

the private school their

children attend, which charges students $35,000

a year.

Illustration by Jason

Seiler.

The documentary’s blind

spots are all the more striking in light of the timing of its release, just

as news

was trickling out that Bill Gates met multiple times with

convicted sex offender Jeffrey Epstein to discuss collaborating on charitable

activities, from which Epstein stood to generate millions of dollars in

management fees. Though the collaboration never materialized, it nonetheless

illustrates the moral hazards surrounding the Gates Foundation’s $50 billion

charitable enterprise, whose sprawling activities over the last two decades

have been subject to remarkably little government oversight or public scrutiny.

While the efforts of fellow

billionaire philanthropist Michael Bloomberg to use his wealth to win the

presidency foundered amid intense media criticism, Gates has proved there is a

far easier path to political power, one that allows unelected billionaires to

shape public policy in ways that almost always generate favorable headlines:

charity.

The billionaire class: Warren Buffett (left) and Bill Gates, two of the

Gates Foundation’s three trustees, sharing a laugh. (Jeff Christensen /

WireImage)

When Gates announced in

2008 that he would step away from Microsoft to focus his efforts on

philanthropy, he described his intention to work with and through the private

sector to deliver public-goods products and technologies, in the same way that

Microsoft’s computer software expanded horizons and created economic

opportunities. Describing his approach by turns as “creative

capitalism” and “catalytic

philanthropy,” Gates oversaw a shift at his foundation to leverage

“all the tools of capitalism” to “connect the promise of philanthropy with the

power of private enterprise.”

The result has been a new

model of charity in which the most direct beneficiaries are sometimes not the

world’s poor but the world’s wealthiest, in which the goal is not to help the

needy but to help the rich help the needy.

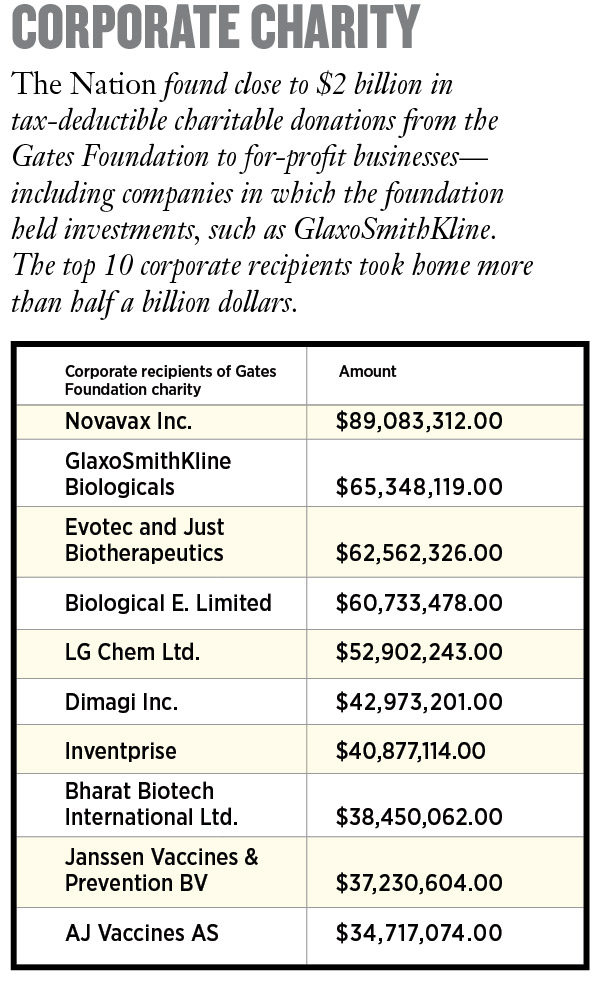

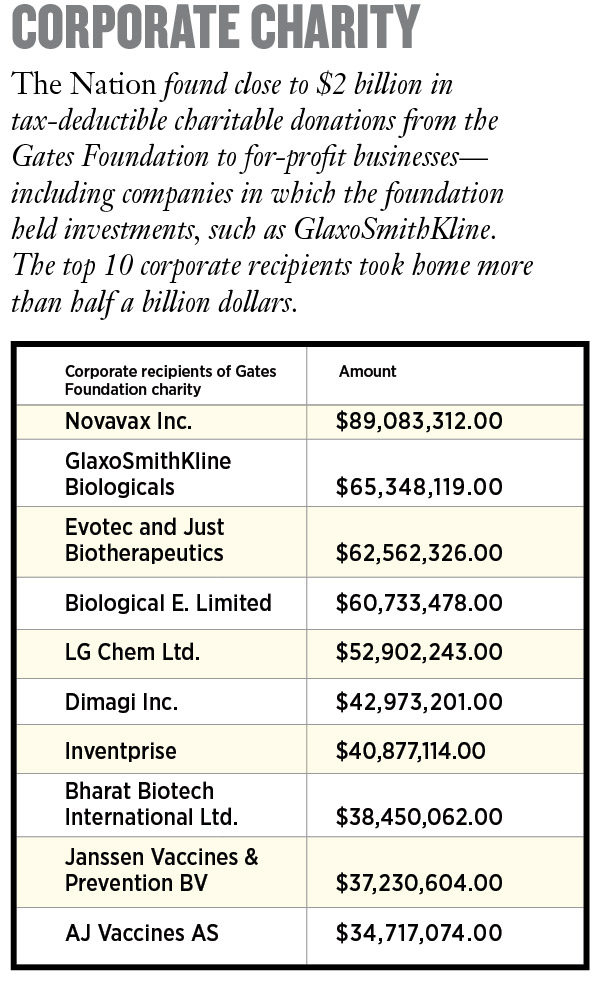

Through an investigation of

more than 19,000 charitable grants the Gates Foundation has made over the last

two decades, The Nation has uncovered close to $2 billion

in tax-deductible charitable donations to private companies—including some of

the largest businesses in the world, such as GlaxoSmithKline, Unilever, IBM,

and NBC Universal Media—which are tasked with developing new drugs, improving

sanitation in the developing world, developing financial products for Muslim

consumers, and spreading the good news about this work.

The Gates Foundation even

gave $2 million to Participant Media to promote Davis Guggenheim’s previous

documentary film Waiting for Superman, which pushes one of the

foundation’s signature charity efforts, charter schools—privately managed

public schools. This charitable donation is a small part of the $250 million

the foundation has given to media companies and other groups to influence the

news.

“It’s been a quite

unprecedented development, the amount that the Gates Foundation is gifting to

corporations…. I find that flabbergasting, frankly,” says Linsey McGoey, a

professor of sociology at the University of Essex and author of the book No

Such Thing as a Free Gift. “They’ve created one of the most problematic

precedents in the history of foundation giving by essentially opening the door

for corporations to see themselves as deserving charity claimants at a time

when corporate profits are at an all-time high.”

McGoey’s research has

anecdotally highlighted charitable grants the Gates Foundation has made to

private companies, such as a $19 million donation to a Mastercard affiliate in 2014 to “increase usage of digital financial

products by poor adults” in Kenya. The credit card giant had already

articulated its keen business interest in cultivating new clients from the

developing world’s 2.5 billion unbanked people, McGoey says, so why did it need

a wealthy philanthropist to subsidize its work? And why are Bill and Melinda

Gates getting a tax break for this donation?

These questions seem

especially pertinent in light of the fact that the donation to Mastercard may

have delivered financial benefits to the Gates Foundation; at the time of the

donation, in November 2014, the foundation’s endowment had substantial

financial investments in Mastercard through its holdings in Warren Buffett’s

investment company, Berkshire Hathaway. (Buffett himself has pledged $30

billion to the Gates Foundation. )

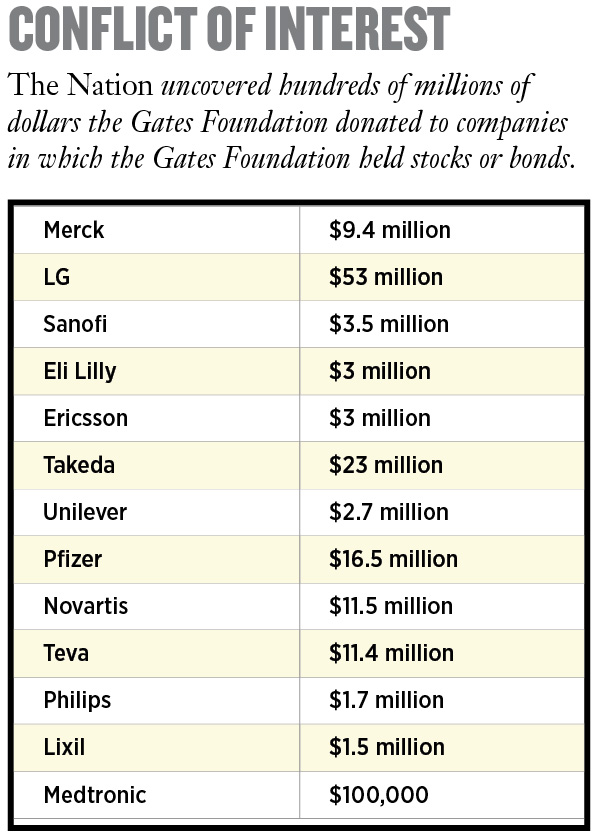

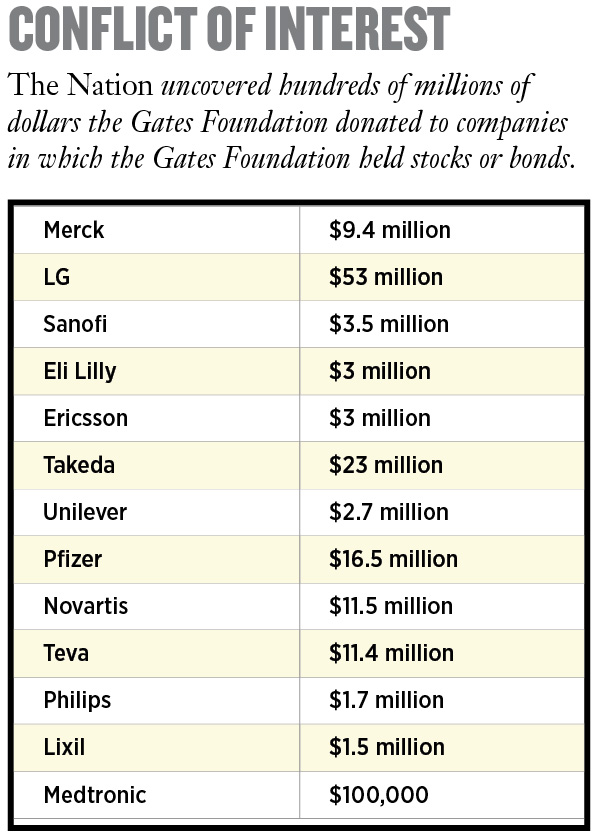

The Nation found close to $250 million in charitable grants

from the Gates Foundation to companies in which the foundation holds corporate

stocks and bonds: Merck, Novartis, GlaxoSmithKline, Vodafone, Sanofi, Ericsson,

LG, Medtronic, Teva, and numerous start-ups—with the grants directed at projects

like developing new drugs and health monitoring systems and creating mobile

banking services.

A foundation giving a

charitable grant to a company that it partly owns—and stands to benefit from

financially—would seem like an obvious conflict of interest, but judging from

the sparse rules that Congress has written governing private foundations and

the IRS’s light enforcement of them, many in the federal government do not

appear to see it that way.

The Gates Foundation did not

respond to specific questions about its work with the private sector, nor would

it provide its own accounting of how much money it has given to for-profit

companies, saying that “many grants are implemented through a mixture of

non-profit and for-profit partners, making it difficult to evaluate exact

spending.”

At business-friendly events,

however, Bill Gates openly promotes his foundation’s work with companies. In

speeches delivered at the American Enterprise Institute and Microsoft in 2013

and ‘14, he trumpeted the lives his foundation was saving—in one speech he said

10 million, in another 6 million—through “partnerships with pharmaceutical

companies.”

Yet the foundation is doing

more than simply partnering with companies: It is subsidizing their research

costs, opening up markets for their products, and bankrolling their bottom

lines in ways that, by and large, have never been publicly examined—even as you

and I, dear reader, are subsidizing this work.

Bill Gates frequently boasts about having paid

more taxes—$10 billion—than anyone else. That may or may not be true; the

Gates Foundation would not release his tax forms or provide any substantiating information.

But he may also end up avoiding more taxes than anyone else, through charitable

giving.

By Bill and Melinda Gates’s

estimations, they have seen an 11

percent tax savings on their $36 billion in charitable

donations through 2018, resulting in around $4 billion in avoided taxes. The

foundation would not provide any documentation related to this number, and

independent estimates from tax scholars like Ray Madoff, a law professor at

Boston College, indicate that multibillionaires see tax savings of at least 40

percent—which, for Bill Gates, would amount to $14 billion—when you factor in

the tax benefits that charity offers to the superrich: avoidance of capital

gains taxes (normally 15 percent) and estate taxes (40 percent on

everything over $11.58 million, which in Gates’s case is a lot).

Madoff, like many tax

experts, stresses that these billions of dollars in tax savings have to be seen

as a public subsidy—money that otherwise would have gone to the US Treasury to

help build bridges, do medical research, or close the funding gap at the IRS

(which has resulted in fewer audits of

billionaires). If Bill and Melinda Gates don’t pay their full

freight in taxes, the public has to make up the difference or simply live in a

world where governments do less and less (educating, vaccinating, and

researching) and superrich philanthropists do more and more.

Get unlimited digital access

to the best independent news and analysis.

“I think people often

confuse what wealthy people are doing on their own dime and what [they’re]

doing on our dime, and that’s one of the big problems about this debate,”

Madoff notes. “People say, ‘It’s the rich person’s money [to spend as they

wish].’ But when they get significant tax benefits, it’s also our money. And so

that’s why we need to have rules about how they spend our money.”

Naturally, Big Philanthropy

has special interest groups pushing back on the creation of such rules. The

Philanthropy Roundtable defends the wealthiest Americans’ “freedom to give,”

describing itself as fighting the “increasing pressures from some public

officials and advocacy groups to subject private philanthropies to more uniform

standards and stricter government regulation.”

The nonprofit group receives

funding from influential right-wing

billionaires, including hundreds of thousands of dollars from the

private foundation of Charles Koch. And it gets substantial funding from the

Gates Foundation: nine grants from 2005 to 2017, worth $2.5 million,

mostly for general operating expenses. A spokesperson for the foundation says

these donations are aimed at “mobilizing voices to advocate for public policies

that further enable charitable giving.”

At a certain point, however,

the Philanthropy Roundtable seems primarily to serve the private interests of

billionaires like the Gateses and Koch who use charity to influence public

policy, with limited oversight and substantial public subsidies. It’s unclear

how the Philanthropy Roundtable’s work contributes to the Gates Foundation’s

charitable missions “to help all people live healthy, productive lives” and “to

empower the poorest in society so they can transform their lives.”

While there is no credible argument

that Bill and Melinda Gates use charity primarily as a vehicle to enrich

themselves or their foundation, it is difficult to ignore the occasions where

their charitable activities seem to serve mainly private interests, including

theirs—supporting the schools their children attend, the companies their

foundation partly owns, and the special interest groups that defend wealthy

Americans—while generating billions of dollars in tax savings.

Philanthropy has also

delivered a public relations coup for Bill Gates, dramatically transforming his

reputation as one of the most cutthroat CEOs to one of the most admired people

on earth. And his model of charity, influence, and absolution is inspiring a

new era of controversial tech billionaires like Mark Zuckerberg and Jeff Bezos,

who have begun giving away their billions, sometimes working directly

with Gates.

Gates was already one of the

richest humans on earth in 2008, but he was also an embattled billionaire,

still licking his wounds from a series of legal battles around the monopolistic

business practices that made him so extravagantly wealthy—and that compelled

Microsoft to pay billions of dollars in fines and settlements.

Gates did not respond to

multiple requests for interviews, but in a recent Q&A with The

Wall Street Journal, he revisited his legal face-off with

antitrust regulators, saying, “I can still explain to you why the government

was completely wrong, but that’s really old news at this point. For me

personally, it did accelerate my move into that next phase, two to five years

sooner, of shifting my focus over to the foundation.”

Gates’s view of Microsoft as

the victim of overzealous antitrust regulations may help explain the

laissez-faire ethos driving his charitable giving. His foundation has given

money to groups that push for industry-friendly government policies and

regulation, including the Drug Information Association (directed by Big Pharma)

and the International Life Sciences Institute (funded by Big Ag). He has also

funded nonprofit think tanks and advocacy groups that want to limit the role of

government or direct its resources toward helping business interests, like the

American Enterprise Institute ($6.8 million), the American Farm Bureau

Foundation ($300,000), the American Legislative Exchange Council ($220,000),

and organizations associated with the US Chamber of Commerce ($15.5 million).

Between 2011 and 2014 the

Gates Foundation gave roughly $100 million to InBloom, an educational

technology initiative that dissolved in controversy around privacy issues and

its collection of personal data and information about students. To Diane

Ravitch, a professor of education at New York University, InBloom illustrates

the way Gates is “working to push technology in classrooms, to replace teachers

with computers.”

“That affects Microsoft’s

bottom line,” Ravitch observes. “However, I’ve never made that argument…. [The

foundation] is not looking to make money from this business. They have an

ideological interest in free markets.”

Education isn’t the only

area where Gates’s ideological interests overlap with his financial interests.

Microsoft’s bottom line is heavily dependent on patent protections for its

software, and the Gates Foundation has been a strong and consistent supporter

of intellectual property rights, including for the pharmaceutical companies

with which it works closely. These patent protections are widely criticized for

making lifesaving drugs prohibitively expensive, particularly in the developing

world.

“He uses his philanthropy to

advance a pro-patent agenda on pharmaceutical drugs, even in countries that are

really poor,” says longtime Gates critic James Love, the director of the

nonprofit Knowledge Ecology International. “Gates is sort of the right wing of

the public-health movement. He’s always trying to push things in a pro-corporate

direction. He’s

a big defender of the big drug companies. He’s undermining a lot of things that are really

necessary to make drugs affordable to people that are really poor. It’s weird because he gives so much money to [fight]

poverty, and yet he’s the biggest obstacle on a lot of reforms.”

Doing well while doing good: The Gates Foundation’s sprawling work with

for-profit companies has created a welter of conflicts of interest. (Pius

Utomi Ekpei / AFP via Getty Images)

The Gates Foundation’s sprawling work with for-profit

companies has created a welter of conflicts of interest, in which the

foundation, its three trustees (Bill and Melinda Gates and Buffett), or their

companies could be seen as financially benefiting from the group’s charitable

activities.

Buffett’s Berkshire Hathaway

has billions of dollars in investments in companies that the foundation has

helped over the years, including Mastercard and Coca-Cola. Bill Gates long

sat on the board of directors at Berkshire, announcing his departure just last

week, and he and his foundation together hold billions of dollars of equity

stake in the investment firm.

The foundation’s work also

appears to overlap with Microsoft’s, to which Gates, in recent years, has

devoted one-third of his workweek. (Gates announced last week he would be

stepping down from the company’s board, but remain involved with the company as

a technology advisor). The Gates Foundation’s $200 million program to

improve public libraries partnered with Microsoft to donate the company’s

software, prompting criticism that

the donations were aimed at “seeding the market” for Microsoft products and

“lubricating future sales.” Elsewhere, Microsoft is investing money studying

mosquitoes to help predict disease outbreaks, working with the same researchers

as the foundation. Both projects involve creating sophisticated robots and

traps to collect and analyze mosquitoes.

“The foundation and

Microsoft are separate entities, and our work is wholly unrelated to Microsoft,”

a Gates Foundation spokesperson says.

In 2002, The Wall

Street Journal reported that Gates and the Gates Foundation’s

endowment made new investments in Cox Communications at the same time that

Microsoft was in discussion with Cox about a variety of business deals. Tax

experts raised questions about self-dealing, noting that foundations can lose

their tax-exempt status if they are found to be using charity for personal

gain. The IRS would not comment on whether it investigated, saying, “Federal law

prohibits us from discussing specific taxpayers or organizations.”

Gates is notoriously

secretive about his personal investments, however, making it

difficult to understand if he stands to gain financially from his foundation’s

activities or the extent to which he does if this happens.

“It’s hard to draw the line

between a) Microsoft; b) his own personal wealth and investment; and c) the

foundation,” says consumer advocate Ralph Nader, one of Microsoft’s fiercest

critics in the 1990s. “There’s been very inadequate media scrutiny of all

that.”

The foundation’s clearest

conflicts of interest may be the grants it gives to for-profit companies in

which it holds investments—large corporations like Merck and Unilever. A

foundation spokesperson said it tries to avoid this kind of financial conflict

but that doing so is difficult because its investment and charitable arms are

firewalled from one another to keep their activities strictly separate. Bill

and Melinda Gates are trustees of both entities, however, making it difficult

to draw a sharp line between the two.

And in some places, the

Gates Foundation explicitly marries its investing and charitable activities.

Gates’ “strategic investment fund,” which the foundation

says is designed to advance its philanthropic goals, not to generate investment

income, includes a $7 million equity stake in the start-up company AgBiome,

whose other investors include the agrochemical companies Monsanto and Syngenta.

The foundation also gave the company $20 million in charitable grants to

develop pesticides for African farmers. Similarly, the foundation has a $50

million stake in Intarcia and an $8 million investment in Just Biotherapeutics,

to which it gave $25 million and $32 million in charitable grants,

respectively, for work related to HIV and malaria. At one point, the foundation

held a 48 percent stake in an HIV diagnostic company called Zyomyx, to which it

previously awarded millions of dollars in charitable grants.

A league of their own: Bill Gates Sr. (left) and his son prepare to

throw out the first pitch for the Seattle Mariners in 2013. (Elaine

Thompson / AP)

Asked about these apparent

conflicts of interest, the foundation says that grants and investments “are

simply two tools the foundation uses as appropriate to further its charitable

objectives.”

When Gates began his foundation in 1994, he put his

father, Bill Gates Sr., in charge. A prominent lawyer in Seattle, Gates Sr. was

also a civic leader and, later, a public advocate on issues related to income

inequality.

Working with Chuck Collins,

an heir to the Oscar Mayer fortune who gave away much of his inheritance during

his 20s, Gates Sr. helped organize a successful national campaign in the late

1990s and early 2000s to build political power around preserving the estate

tax, the taxes levied against the assets of the wealthy after they die.

In interviews Gates Sr. gave

at the time (he has Alzheimer’s disease now and was not contacted for an

interview), his advocacy work seemed designed not to generate tax revenues but

to inspire philanthropy.

“A wealthy person has an absolute

choice as to whether they pay the [estate] tax or whether they give their

wealth to their university or their church or their foundation,” he

told journalist Bill Moyers.

That’s because when the rich

give away their wealth, they reduce the assets that the estate tax targets. But

such an arrangement, whereby the wealthiest Americans get to decide for

themselves whether they want to pay taxes or donate their money to

charity—including to groups that influence government policy—sounds like a peak

example of tone-deaf privilege. In many respects, that’s how the tax system

works for the superrich.

“The richer you are, the

more choice you have between those two,” says Collins, who today works on

income inequality at the nonprofit Institute for Policy Studies.

For some billionaire

philanthropists, it may be less of a choice than an entitlement. Buffett and

Gates have recruited hundreds of millionaires and billionaires to sign the

Giving Pledge, a promise to donate most of their wealth to charity, which some

signatories explicitly cite as an alternative to paying taxes.

According to Collins, Bill

Gates Sr. had a nuanced view that included limiting billionaires’ tax benefits.

“He said to me…it’s a

problem that his son is going to give—at the time, it was like $80 billion—to

the foundation and never have to pay taxes on any of that wealth,” Collins

recalls. “His view was that there should be a cap on the lifetime amount of

wealth that could be given to charity where you get a deduction.”

Around the time that Collins

and Gates Sr. were putting pressure on Congress to make sure the wealthy pay

their fair share of taxes, the younger Gates was running a multinational

company aggressively looking for tax breaks. According to the assessor’s office

for King County, which includes Seattle, Microsoft has filed 402 appeals on its

property taxes. Likewise, a 2012

Senate investigation examined Microsoft’s aggressive use of

offshore subsidiaries to save the company billions of dollars in taxes.

And The Seattle Times reported that Microsoft spent decades

creating lucrative, tax-reducing barriers around corporate profits.

Bill Gates, nevertheless,

has managed to become a leading—and seemingly progressive—public voice on tax

policy. Every year around tax time, he and Buffett make media appearances

decrying how little they pay in taxes, calling on Congress to raise taxes on

the wealthy. At times, however, they advocate policies that may not actually

touch their wealth, such as promoting the estate tax, which they will likely

avoid through charitable donations.

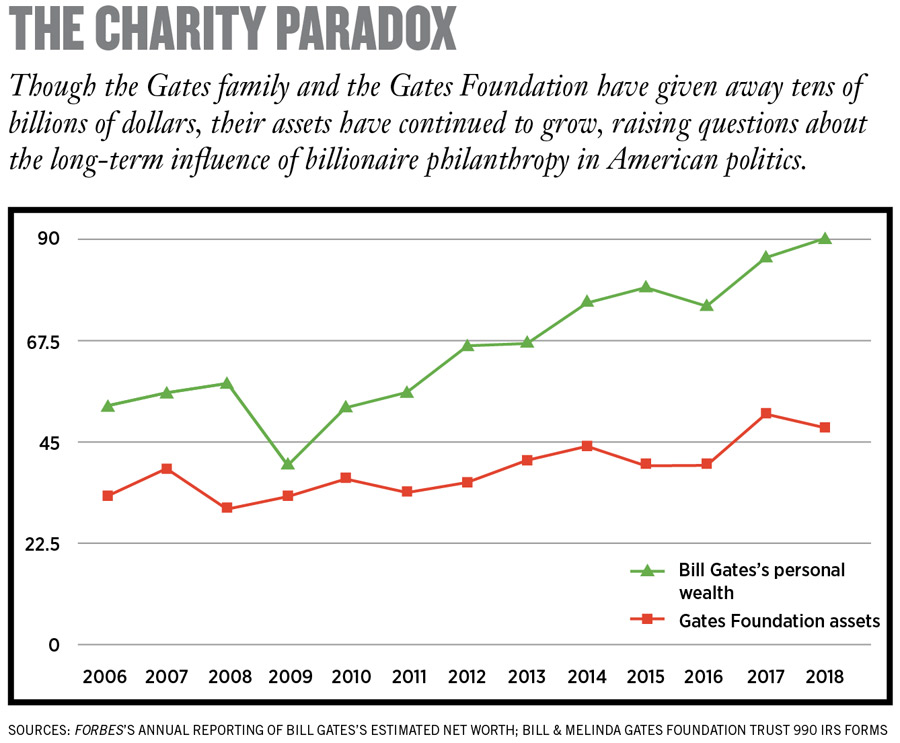

Gates, along with a growing

chorus of billionaires, has also used his public platform to push back on a

proposed wealth tax, supported by both Elizabeth Warren and Bernie Sanders. A

wealth tax would take a percentage of a billionaire’s assets every year,

limiting the accumulation of wealth—and possibly the amount of money spent on

philanthropy. Gates counters that charity work reduces income inequality.

“Philanthropy done well not

only produces direct benefits for society, it also reduces dynastic wealth,” he

wrote on his blog, GatesNotes.

When the Gates foundation has faced criticism in regard

to its endowment—including investments in prisons, fast food, the arms industry,

pharmaceutical companies, and fossil fuels—conflicting with its charitable

mission to improve health and well-being, Gates has pushed back in

black-and-white terms, calling divestment a “false solution” that will have

“zero” impact.

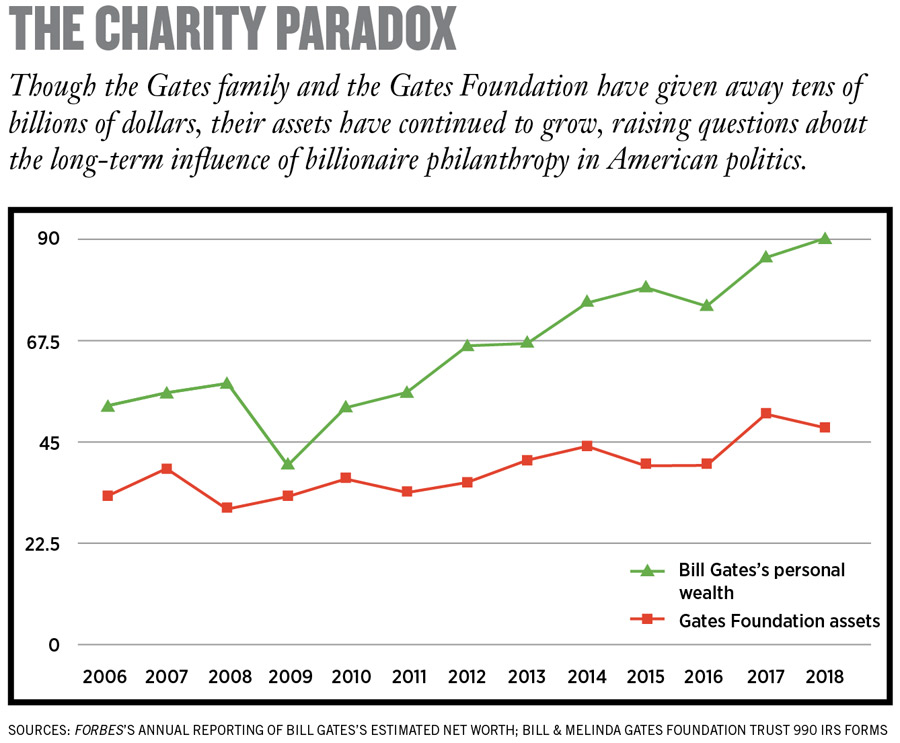

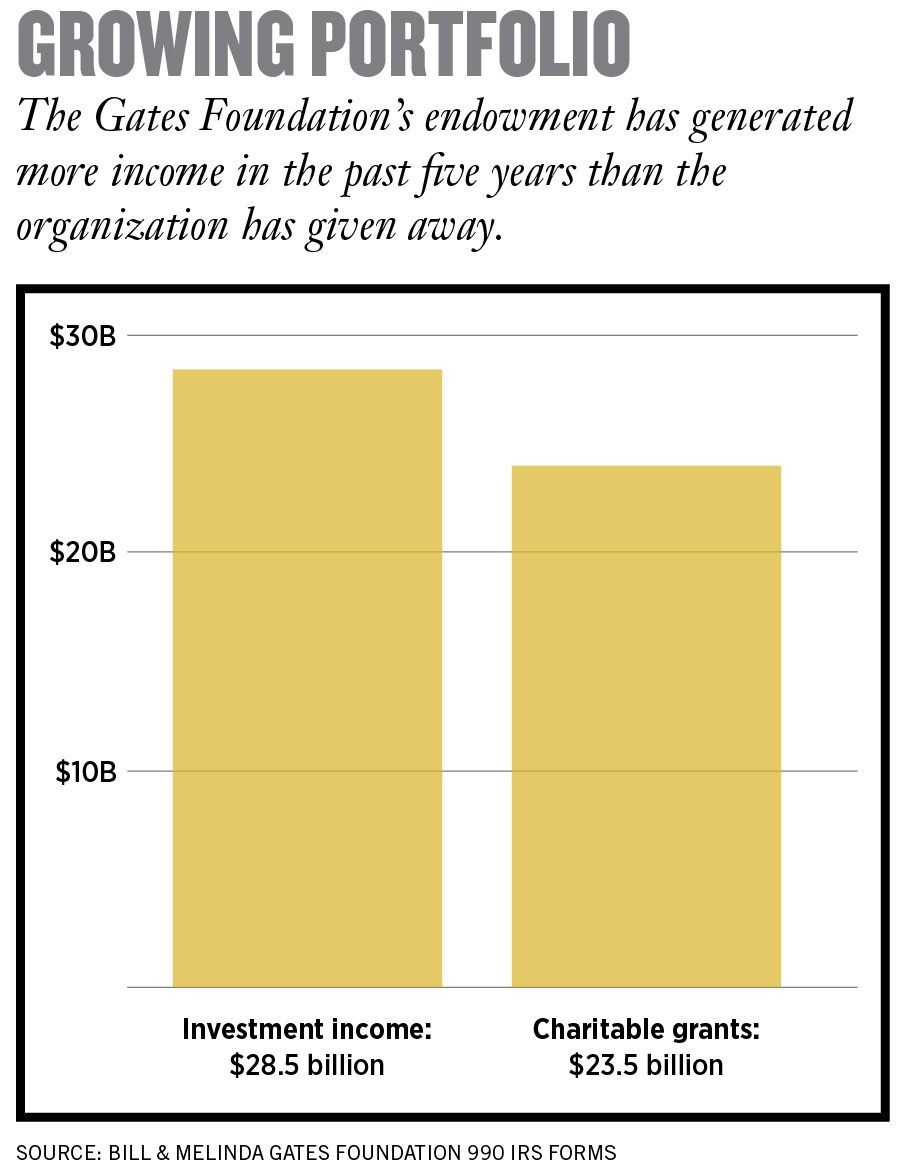

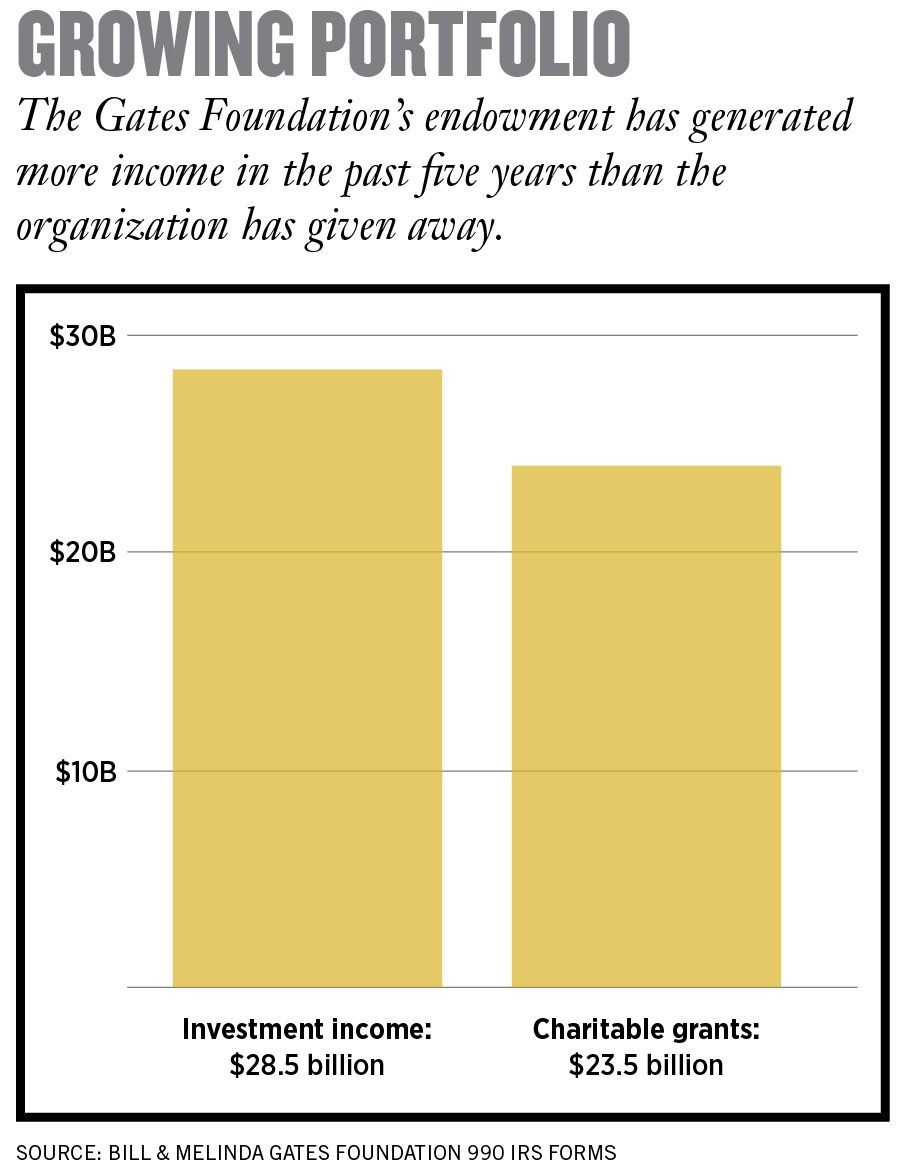

The Gates Foundation’s

investments are not an insignificant part of its charitable efforts. Its $50

billion endowment has generated $28.5 billion in investment income over the

last five years. During the same period, the foundation has given away only

$23.5 billion in charitable grants.

In 2007, in one of the few

investigative journalism series ever published about the foundation, the Los

Angeles Times profiled the foundation’s investments in

mortgage lenders involved in subprime loans and for-profit hospitals accused of

performing unneeded surgeries. The Times also noted the

foundation’s investments in chocolate companies that depend on

cocoa production using child labor.

The Gates Foundation

spokesperson says it “does not comment on specific investment decisions or

holdings,” but did note that the “sole purpose” of its endowment is “to provide

income to support the Foundation’s mission and to be capable to do so over the

long term.”

The Gates Foundation’s

endowment currently has an $11.5 billion stake in Berkshire Hathaway,

which in turn has $32 million invested in the chocolate company Mondelez,

which has been criticized in relation to the use of child labor. The foundation

made $32.5 million in charitable donations to the World Cocoa Foundation, an

industry group whose members include Mondelez, for a project to improve farmer

livelihoods. The project doesn’t appear to address child labor.

The tax reform act of 1969

created special rules to limit the influence that wealthy philanthropists could

exercise through private foundations—in theory ensuring they produce public

benefits rather than serve private interests.

In practice, these rules

give wealthy donors like Bill and Melinda Gates enormous latitude in their

philanthropic activities. For example, when it comes to self-dealing, the IRS

prohibits only the most egregious conflicts of interest, such as foundations

awarding grants to companies controlled by board members. Likewise, IRS rules

broadly allow charitable donations to for-profit companies, as long as the

foundations keep paperwork showing that the money was used to advance their

charitable missions.

But because the Gates

Foundation views market-based solutions and private-sector innovation as public

goods, the line between charity and business can be indistinguishable.

Sociologist Linsey McGoey says, “They’ve defined their charitable mission so

broadly and loosely that literally any for-profit company could be said to be

meeting the Gates Foundation’s general goal of improving social and global

well-being.”

The IRS’s oversight of

private foundations is constrained by recent budget cuts and its limited

mandate to collect taxes from nonprofits like the Gates Foundation, which are

largely free from paying them.

“If you’re the IRS

commissioner and you’re given a finite sum to spend on the agency, and your job

is to make sure the US Treasury has money in it, you are going to give a token

nod to tax-exempt organizations,” says Marc Owens, a former director of the

IRS’s tax-exempt division who is now in private practice. “One [IRS] agent

looking at restaurants in Washington or New York City is going to generate a

lot of money…. One agent looking at private foundations will probably pay their

salary, but it’s not going to bring in tax dollars.”

Reputation repair: Bill and Melinda Gates leaving court after

testifying in the 2002 Microsoft antitrust trial. They have become known as

famous philanthropists rather than corporate predators. (Kenneth

Lambert / AP)

According to IRS statistics,

there are around 100,000 private foundations in the United States, housing close

to $1 trillion in assets. However, foundations generally pay a tax rate of only

1 or 2 percent, and the IRS reports auditing, at most, 263 foundations in 2018.

State attorneys general can

exercise oversight of private foundations, as the New

York attorney general’s office did in 2018 when it investigated

Donald Trump’s private foundation, which shut down amid allegations that he

used it for his personal benefit. The Gates Foundation’s location in Seattle

gives the state of Washington purview over its charitable work, but the state

attorney general’s office there says it did not have full-time staff dedicated

to investigating charitable activities until 2014, a decade after the

foundation became the largest philanthropy in the world. The Washington AG’s

office would not comment on whether it has ever investigated the Gates

Foundation.

Bill Gates’s outsize charitable giving—$36

billion to date—has

created a blinding halo effect around his philanthropic work, as many of the

institutions best placed to scrutinize his foundation are now funded by Gates,

including academic think tanks that churn out uncritical reviews of its

charitable efforts and news outlets that praise its giving or pass on

investigating its influence.

In the absence of outside

scrutiny, this private foundation has had far-reaching effects on public

policy, pushing

privately run charter schools into states where courts and

voters have rejected them, using earmarked funds to direct the World Health

Organization to work on the foundation’s global health agenda, and subsidizing

Merck’s and Bayer’s entry into developing countries. Gates, who routinely

appears on the Forbes list of the world’s most powerful

people, has proved that philanthropy can buy political influence.

Gates’s personal wealth is

greater today than ever before, around $100 billion, and at only 64 years

of age, he may have decades left to donate this money, picking up a Nobel Prize

along the way or—who knows?—a presidential nomination. The same could be said

of Melinda Gates, who, at 55, recently took a big step into public life with a

highly publicized book tour.

But it’s also possible that

a day of reckoning is coming for Big Philanthropy, Bill Gates, and the growing

number of billionaires following his footsteps into charity.

Economists, politicians, and

journalists continue to put a spotlight on billionaires who aren’t paying their

fair share of taxes but who shape politics through campaign contributions and

lobbying. Charity is seldom regarded as a tax-avoiding tool of influence, but

if income inequality continues to gain attention, there is simply no way to

avoid asking tough questions of Big Philanthropy. Do billionaire

philanthropists have too much power, with too little public accountability or

transparency? Should the wealthiest Americans have carte blanche to spend their

wealth any way they want?

It may seem like a radical

proposition to challenge the ability or desire of multibillionaires to give

away their fortunes, but such scrutiny has a historical precedent in mainstream

politics. One hundred years ago, when oil baron John D. Rockefeller asked

Congress to provide him with a charter to start a private foundation, his

ambitions were soundly rejected as an anti-democratic power grab. As Theodore

Roosevelt said at the time, “No amount of charities in spending such fortunes

can compensate in any way for the misconduct in acquiring them.”

Editor’s note: this post has

been updated.

Tim Schwab is a freelance journalist based in

Washington, DC, whose investigation into the Gates Foundation was part of a

2019 Alicia Patterson Foundation fellowship.

/https://www.niagarafallsreview.ca/content/dam/thestar/news/canada/2021/09/25/huawei-executive-meng-wanzhou-receives-warm-welcome-upon-return-to-china/_1_meng_wanzhou_2.jpg)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.